[15 min read]

After reading the book ‘Zero to One,‘ precisely three months ago, it continued to linger on my mind even though I was still completing about two or three books per week.

As a result, I felt compiled to instantly re-organize my time so that I could reflect on its secrets, and weigh its strengths and weaknesses as soon as possible.

As the writer, Peter Thiel, states, Zero to One is about how to build a technology company that creates new things, the by-product of a course that he taught at Standford University in 2012, about startups.

But, in my opinion, it is much more than that…

In light of the fact that our dominant thoughts and feelings will ultimately decide what we achieve and become, I feel that it is my responsibility to urgently share with you, and catalogue, Thiel’s intelligence…

Because this book ‘…is not a manual or a record of knowledge but an exercise in thinking (p. 11)’ about aspects of society that have a significant impact on the quality of our lives.

Ultimately, this review will seek to emphasis the nature of Thiel’s thinking which, in my view, being deeply profound and extra-ordinary, should in many ways be replicated or utilized in business.

.

Peter Thiel

Born on 11th October 1967 (49 years old), according to Wiki, Thiel is a German-American entrepreneur, venture capitalist and hedge fund manager, who

-

was a competitive and highly ranked under 21 chess player,

-

completed law school in 1992,

-

traded derivatives for the Credit Suisse Group from 1993 to 1996,

-

founded Thiel Capital Management (a multistrategy fund) in 1996,

-

was a co-founder of PayPal, a successful online payment system, in 1998, which became a public company on the New York Stock Exchange in 2002 – netting Thiel $55 million for his 3.7 percent equity share in the company,

-

made a $500,000 investment in Facebook and became a director for 10.2% of the company in 2004,

-

created a global macro fund: Clarium Capital, which was awarded as a global macro strategy fund of the year by two trade magazines: MarHedge and Absolute Return in 2005,

-

created Founders Fund in 2005, a venture capital fund that has made early investments in numerous startups such as LinkedIn, Yelp and Airbnb,

-

sold almost all of his remaining shares in Facebook in 2012, receiving in total more than a $1 billion in returns from the company since his initial $500,000 investment in 2004, and

-

in 2016, has a net worth believed to be $2.7 Billion dollars.

.

The Future of Progress

Throughout the book, Thiel presents a series of arguments and questions that logically connect and build off of one another, starting with

What important truth do very few people agree with you on? (p.5)

To answer the above question, which he asserts may be the key to becoming successful in the business of doing new things; within chapter one, Thiel states that:

-

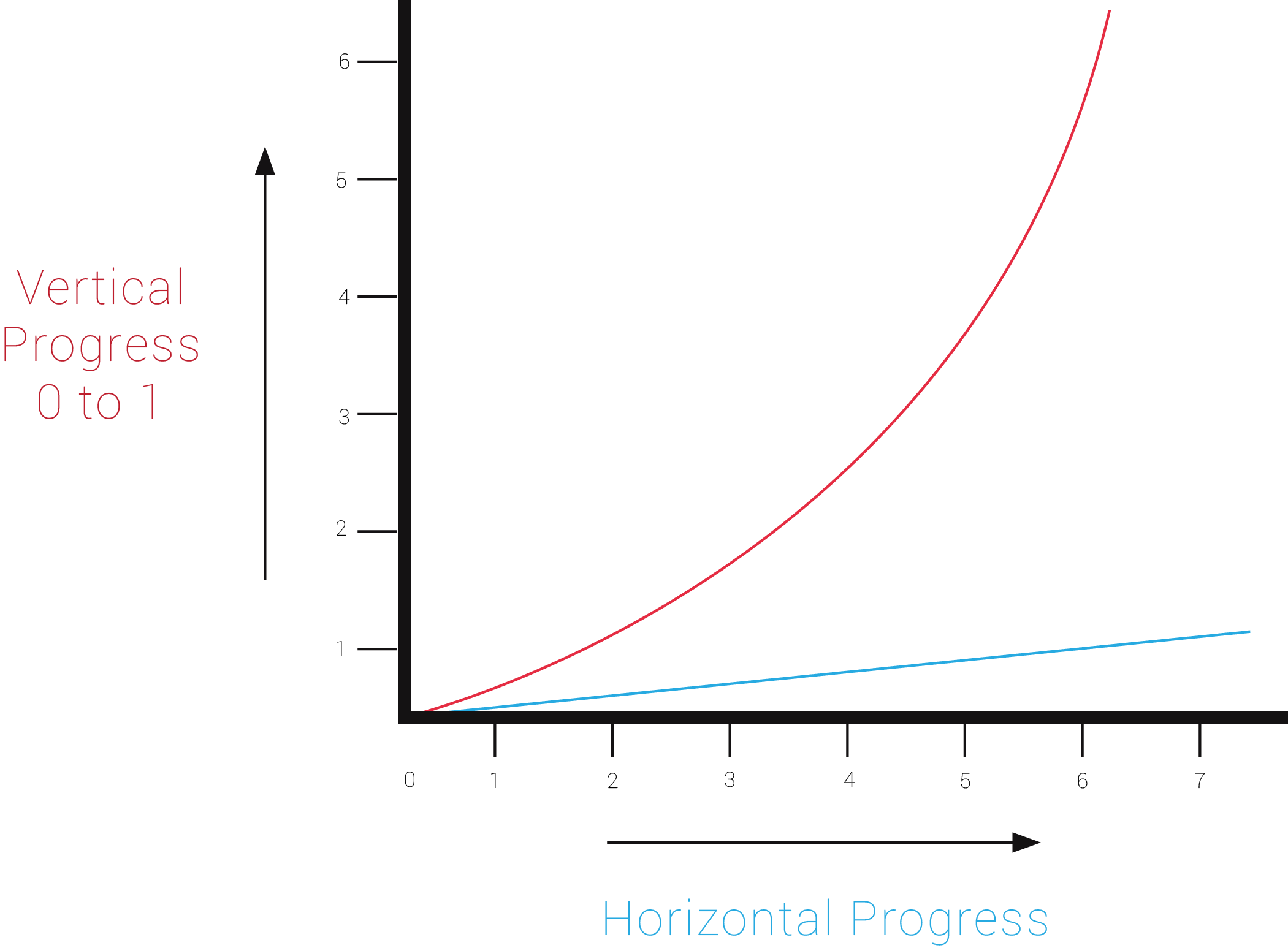

When you think about the future it can be in one of two ways: Horizontal Progress and Vertical Progress.

-

Horizontal Progress is when we copy something that has already been done, making it easy to picture. As an example, Thiel states that if we take a typewriter and then build 100 typewriters that is a fine illustration of making horizontal progress.

-

Vertical Progress means doing new things, creating something that has never been done. In other words, going from 0 to 1, like starting with a typewriter then ending up creating a word processor.

-

Vertical Progress, or going from 0 to 1, is captured and summarized by the word technology. This is because the term technology is used to describe any new and better way of doing things.

-

New technology tends to come from new ventures such as startups.

-

Startups are the largest group of people that can be convinced to follow a plan to build a different future. They have to question received ideas and re-consider business from a clean slate, because fresh thinking is the most important strength of a new company.

It is well known, therefore, that small groups of people working together with a strong sense of purpose, startups, have been responsible for positively changing the world as, alternatively, it is difficult for big organizations and individuals working alone to build new things:

Large institutions with bureaucratic hierarchies are inflexible and slow to make important decisions. And a single genius who could easily create a ingenious piece of art or literature would never be able to create an whole new industry by her/himself.

Returning back to the starting question (above), Thiel concludes by arguing that most people think the future of the world will be defined by globalization (Horizontal Progress) – meaning a continuing increase of western lifestyles and living standards within developing countries such as China, India, and Nigeria until they all also become advance nations.

However, in Thiel’s opinion, the world has scarce resources, meaning that there is not enough commodities such as fossil fuels and fresh water to sustain the earth’s growing population. Thiel believes, therefore, that technology (Vertical Progress) matters more than globalization as there cannot be a sustainable future without new innovations and technology to overcome the world’s environmental challenges. Thus this is a truth that he claims very few people agree with him on!

.

Tom’s Conclusion

Thiel’s numerous assertions that, for example,

-

the future can only be thought about in one of two ways: Horizontal and Vertical Progress, and that

-

new technology comes from new ventures or startups,

Raise further serious questions, among many others, such as what do we consider to be progress, and what do we consider to be new?

However, in the absence of a further detailed analysis concerning his claims, Thiel’s answer to the question resonated with me on the basis that many of my financial intelligence role models – people who I admire for their capacity to understand and analysis the financial world in ways not shared by the majority of people – like Thiel, see a future where there will be a severe lack of earthly resources to cater to the increasing needs of all developing countries.

In this respect, I found Thiel’s conclusion that technology matters more than globalization fascinating, and his attempt to tackle global environmental problems by investing in 0 to 1 technology startups, a very inspiring all round approach.

.

Monopolies vs Competition

Thiel argues that the first step to clear thinking is to question what you really know about the past, as to reject the status-quo it is not necessary to oppose the crowd, but rather to think for yourself.

For instance, in chapter three, Thiel challenges a conventional economic theory – which considers perfect economic competition within the market to be the most ideal and desirable state – by pointing out that:

-

With perfect competition every company within a perfect competitive market sells the same product at a price that is determine by the marketplace (supply and demand). Subsequently, if there is a chance to earn handsome profits, a new company will enter the market, increasing the supply of the product, and driving down its price.

If too many new companies enter the marketplace, however, the price of the product will be driven down so low that all of the companies will suffer losses eventually, forcing some to close down. As a result, with less companies – meaning reduced competition in the market – and continued demand, the price of the product may again rise to a profitable level.

-

In contrast, a monopoly is the opposite of perfect competition in the respect that a company with a monopoly set its own prices, as it has no competitors. Therefore, a monopoly would produce its product and set a price that allows it to maximize its profits.

.

In the real world, every business is successful exactly to the extent that it does something other cannot; therefore, a monopoly is the condition of every successful business. Whereas, all failed companies are the same: they failed to escape the competition.

Certain types of monopolies drive progress because the prospect of years or even decades of monopolistic profits provides them with a powerful incentive to innovate and keep innovating – financing ambitious research projects that companies stuck in competition cannot seriously consider.

There are monopolies that crookedly destroy their rivals, or corruptly secure licenses from governments for instance; however, this book is an advocate, only, for monopolies that are so good at what they do that no other companies can adequately compete such as Google.

Google is a fine example of a company with a monopoly that went from 0 to 1 in relation to providing its online search engine. It has not competed in online search results since the early 2000s, when it superiorly distinguish itself from its rivals Microsoft and Yahoo.

In 2012, Google brought in $50 billion, keeping 21% of this revenue as profit – as opposed to US airline companies combined that created more value serving millions of passengers that year, but made 100 times less profit than Google.

Thiel concludes by stating that if we want to create a business that provides and obtains long-term value and profits then we should build an uncommon company, because perfect competition in the marketplace eventually results in a struggle for business survival, meaning no profit for any entity.

.

Tom’s Conclusion

As a person with a strategic mind, and an awareness of the importance of developing multiple intelligences, Thiel’s argument that we should create a technology business which has a monopoly – if we want to provide and retain long term value and escape the need to be competitive – justified my skepticism towards the majority of tech startups, and businesses in general.

The reason is that the importance of being creative rather than competitive is a frequently emphasized message to all those who seek to achieve superior results or performance, as revealed within

-

The Science of Getting Rich,

-

Start with Why,

-

Elon Musk,

-

The Einstein Factor, and

-

The Power of Full Engagement,

To name just a few. The reality is that the majority of businesses do not have a monopoly, therefore, individuals may find that their companies are, actually, encouraging and training them to become overly competitive thus destructive.

But, on the other hand, I also acknowledge that there are many who would argue, and provide countless examples, that companies such as Google – who are supposedly so good at what they do – as corporations, are in fact more harmful to the long-term survival of society despite the many advantages that they appear to provide in the short-term.

.

Secrets & 7 Principle Questions

There are many chapters throughout Zero to One that I found contained priceless information, which I was unable to explore within the word range of this review, such as

Chapter 8, relating to Secrets: Thiel argues that

-

great companies are built around secrets that are hidden from the outside world, acting as a best middle ground between telling nobody and telling everybody;

-

there are many secrets to find in the world in relation to science, medicine, engineering, technology, and so on but they will only surface or reveal themselves to those who will search relentlessly for them, and

-

the best place to look for secrets is where no one else is looking such as subject areas that have not been standardized, or become a part of the mainstream education system;

.

Chapter 13, Thiel’s 7 Principle Questions for how to use a clear mind to build a monopoly business:

-

The Engineering Question

Can you create breakthrough technology instead of incremental improvements?

-

The Timing Question

Is now the right time to start your particular business?

-

The Monopoly Question

Are you starting with a big share of a small market?

-

The People Question

Do you have the right team?

-

The Durability Question

Will your market position be defensible 10 and 20 years into the future?

-

The Secret Question

Have you identified a unique opportunity that others don’t see? (p. 154)

.

Next Step

Personally, Zero to One has strengthened my commitment to continue learning about technology, analyzing the advantages and secrets of exceptional businesses, and to question:

Whether I should invest my time and energy creating a business, when I can create or invest in a monopoly?

Below, I have listed a series of simple questions to demonstrate how reading Zero to One may expand or clarify your thoughts and values in relation to your business/career – and its relationship to the future:

-

What type of business/workplace do you have or are you thinking of creating (Monopoly or a Business with Competitors)?

-

Are you investing your time or money within a business/workplace that has competitors, therefore, may struggle to survive in the future? If yes, please provide your reasons why (i.e. social and environmental value perhaps)?

-

If your business/workplace has competitors, how can it become a lasting monopoly in accordance with Thiel’s 7 Principle Questions?

-

If you business/workplace has a monopoly, how does it match up to Thiel’s 7 Principle Questions?

-

What company/workplace with a lasting monopoly that fulfill most, if not all, of Thiel’s 7 Principle Questions can you join or invest within?

Warning: Many people are not best suited to create a business, regardless of whether that business will create something new. Therefore, if possible, I would strongly encourage you, first, to carry out a strengths/personality profile that will provide you with valuable information concerning your innate strengths and talents. It may be very important that you take such a profile before you make any commitment towards creating a business. Because, at the least, your profile is highly likely to uncover what aspect of business you will excel at, and thoroughly enjoy, as well as those things that you will hate with a passion. For further guidance, please click on How to Discover Your True Talents in 35 Minutes!

Until the next review…. keep-it-moving!